Europe’s raw materials sector is facing a period of structural change. Demand for critical raw materials is rising sharply, supply chains remain fragile, and regulatory expectations are tightening. Against this backdrop, digital and Earth Observation–driven solutions are increasingly central to how mining and raw materials activities are planned, monitored and governed.

This analysis, carried out by Evenflow as D1.1 Technological, economic, market and policy analysis brings together policy priorities, market dynamics and technology trends, creating a solid reference point for shaping the GoldenRAM platform around real operational needs and credible market opportunities.

Responding to growing pressure on raw materials

A structural imbalance between rising demand and constrained supply is becoming increasingly evident across the raw materials sector. Global demand for critical raw materials (CRMs) is accelerating, driven by renewable energy, electric mobility and digital technologies. Current estimates indicate that the world will need 6.5 billion tonnes of metals by 2050 to meet decarbonisation targets — several times today’s production capacity.

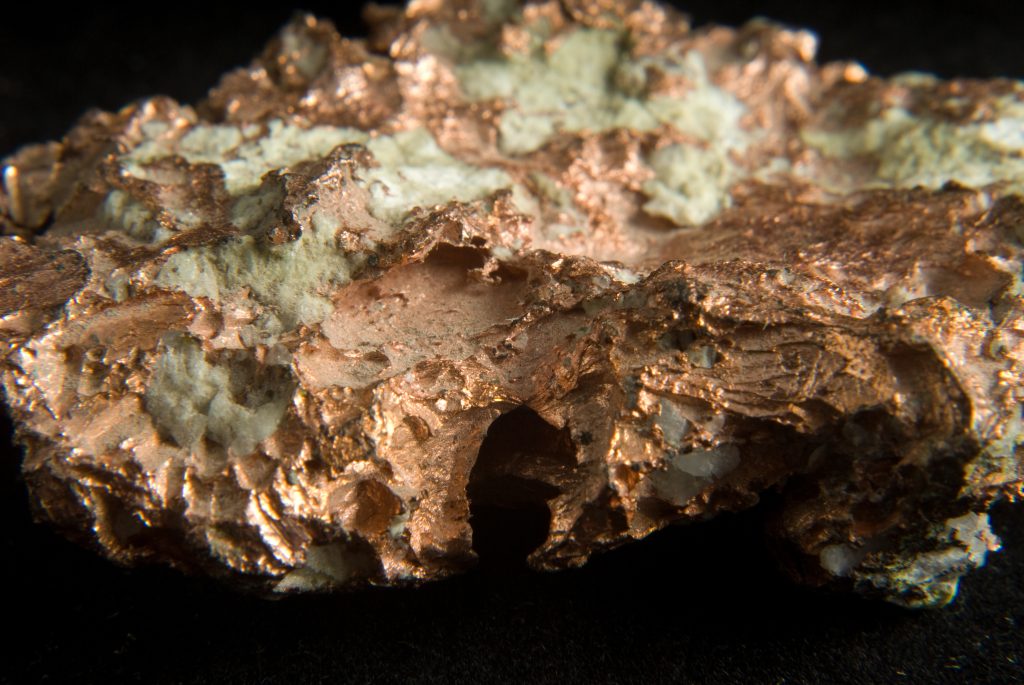

Copper ore with quartz crystals

At the same time, supply chains remain highly concentrated. For many CRMs, Europe depends on a limited number of external suppliers, exposing industries to geopolitical risk, price volatility and potential supply disruptions. This combination of surging demand and fragile supply chains has pushed raw materials security to the top of the EU’s strategic agenda.

GoldenRAM is positioned within this context: its platform is being designed to support more efficient exploration, safer operations and improved monitoring, directly addressing the structural pressures identified in the analysis.

Regulation, sustainability and the compliance gap

Mining is one of the most tightly regulated industrial sectors in Europe. Environmental protection, water management, waste handling, biodiversity and safety obligations are governed by a dense framework of EU directives and national regulations, including the Mining Waste Directive, the Water Framework Directive, and REACH.

Regulatory pressure is increasing rather than easing. New standards, such as the Global Industry Standard on Tailings Management, and stricter expectations for transparency and reporting are raising the bar for operators. Continuous monitoring and auditable data are becoming essential to demonstrate compliance.

Earth Observation (EO) technologies are increasingly recognised as a practical way to bridge this compliance gap. Satellite-based monitoring enables consistent, repeatable and cost-effective oversight of large and remote sites, supporting both operators and regulators in meeting regulatory and sustainability requirements.

Technology trends reshaping mining operations

From a technology perspective, EO and digital tools have moved beyond experimentation and into operational relevance. The report identifies several technologies that are already delivering measurable value across the mining lifecycle:

- Satellite radar (SAR and InSAR) for millimetre-level ground movement and slope stability monitoring, enabling early risk detection.

- Multispectral and hyperspectral imagery to support mineral exploration and environmental monitoring.

- AI and machine learning to process large EO datasets, detect patterns, and reduce uncertainty in decision-making.

- Cloud-based platforms that integrate EO data with in-situ and operational data, enabling collaboration and near real-time insights.

The analysis shows that these technologies are becoming more accessible and more widely adopted. Crucially, their value increases when they are combined within integrated platforms rather than used as isolated tools — a core design principle behind GoldenRAM.

A growing market for digital and smart mining solutions

Market signals point in the same direction. The global mining market was valued at $2.14 trillion in 2023 and is projected to reach $2.83 trillion by 2028. Within this, the smart mining segment — where digital platforms and data-driven services operate — is growing significantly faster.

The serviceable available market (SAM) for data and smart mining platforms is estimated at approximately $1.35 billion, with a realistic serviceable obtainable market (SOM) of around $67 million in the initial years. These figures confirm that there is a credible commercial opportunity for platforms that address efficiency, safety and sustainability challenges.

Importantly, the report shows that mining companies are already investing in digital solutions, particularly where they deliver clear returns in risk reduction, regulatory compliance, and operational efficiency.

Laying the foundation for the GoldenRAM platform

This work is not a theoretical exercise. Its findings directly inform the technical design, use cases, and business strategy of the GoldenRAM platform. By grounding development in a detailed understanding of policy priorities, market demand and technology maturity, the project reduces the risk of misalignment between innovation and real-world needs.

There is both a policy mandate and a market pull for EO-enabled digital platforms in the raw materials sector. GoldenRAM’s next phases build on this evidence, translating analysis into concrete services that support safer, smarter and more sustainable mining operations across Europe and beyond.

In a sector facing unprecedented pressure, data-driven insight is becoming a strategic asset for raw materials.

Those interested in the detailed evidence behind these insights — spanning policy frameworks, technology trends and market dynamics — can explore GoldenRAM’s public deliverable D1.1 Technological, economic, market and policy analysis, which underpins the platform’s development and strategic direction.